The formation of the European Monetary Union (EMU) was a milestone in economic and political integration in Europe, however it was not a first per se. Several times in the past 300 years the attempt has been made to create a stable currency area among sovereign countries. Four historical examples and the stories of their origins and collapse should cast light on the causes of currency area instability. Here the special reasons for, as well as the date of exit of individual union members should be given particular attention. Of course when taken together these overlap in part with the theses of the theory of optimum currency zones established in 1961 by R. Mundell. This theory and its theses should not, however, be the basis of this examination, as it is rather the situation of the individual members towards the end the disintegration of the currency zones which is to be considered than the situation before the formation of the currency union. In doing so, the specific reasons for the exit of each country can be determined. Any failure of a union begins with the diverging interests of its members. Although in the historical currency areas a distinct order of the exit of the member countries is not always discernible, an effective order can be determined. The establishment thereof is dependent upon the intensity of the efforts of the individual members to exit the union. Finally, it will be examined to what extent possible reasons for the members’ exit – as well as other analogous situations which arose during the course of these unions – are also to be found in the current situation in the EMU.

Historical Monetary Unions – Four examples

The Latin Monetary Union and the Scandinavian Monetary Union

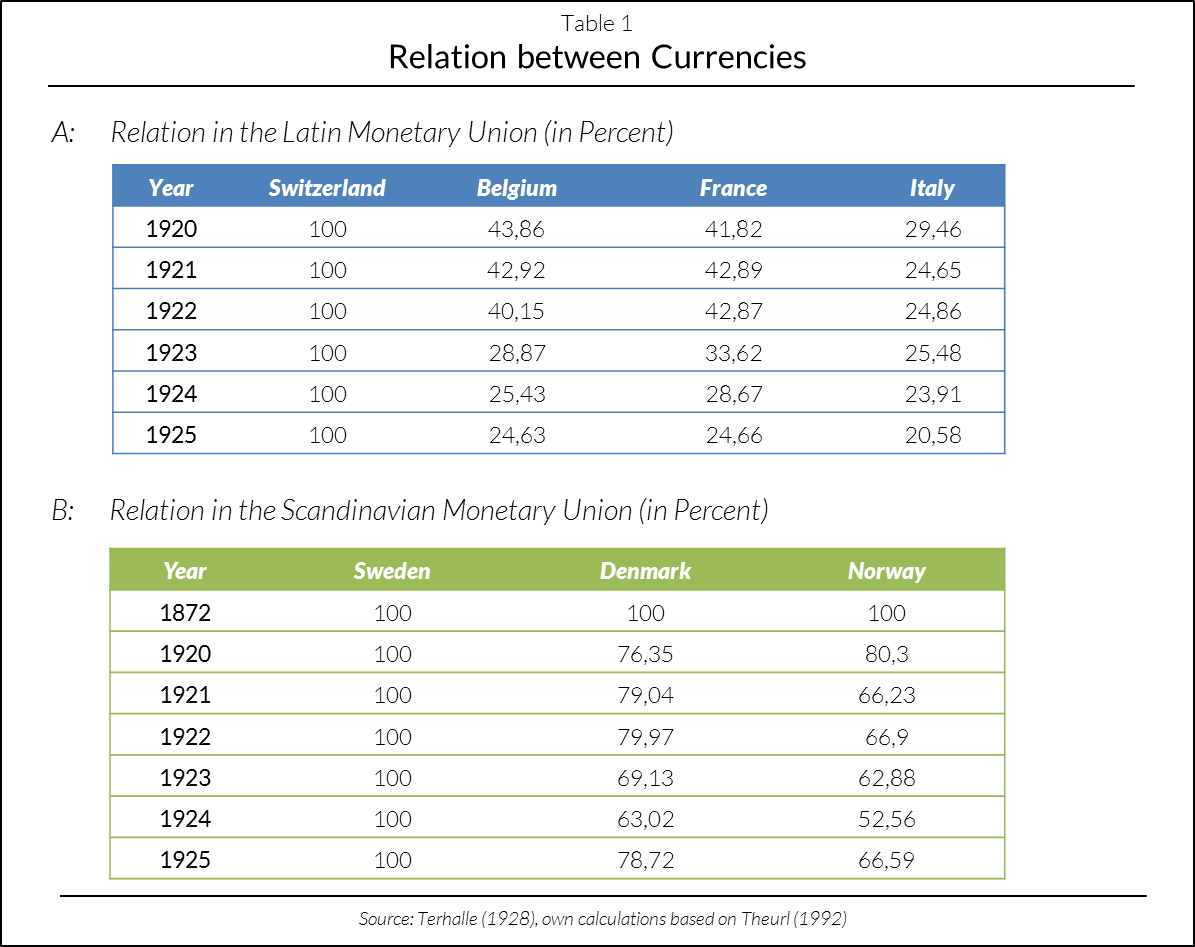

The first two unions to be considered in the framework of this study are the Latin Monetary Union (LMU), which existed from 1865-1927 and which consisted of France, Belgium, Switzerland, Italy and later also Greece; and the Scandinavian Monetary Union (SMU), which joined together Sweden, Denmark, and later also Norway, formed in 1872 and in effect until 1931. The circumstances of these monetary unions are comparable to those of the EMU in that in all three cases the member countries are sovereign nations which voluntarily joined together to create a currency union.

In the case of the LMU and SMU, however, the union-wide regulations related only to the coinage system and decisions regarding the amount of coins to be minted were left up to the individual countries. Parities of coinage produced by the member nations were set at 1:1 and could circulate freely throughout the territory of the union. The increasing significance of banknotes only found entry inside the SMU through the at that time mutual acceptance of their parity. In the case of both unions the coinage systems of the member countries were similar before the unions’ formation, which simplified the step towards a unified coinage. Over the course of time the originally relatively stable monetary cooperation in the LMU and the SMU experienced various setbacks. In the case of the LMU one of the most substantial problems was the physical basis of the coinage system. Here the uncertainty resulted from the bimetallic standard of gold and silver, as compared to that of gold alone, as in the SMU. At that time gold and silver had a prevailing value ratio of 1:15.5 as monetary metals. The increasing deterioration in the price of silver in this fixed value relationship led to a heavy inflow of silver coins and a heavy outflow of gold coins. In spite of the subsequent suspension of the minting of silver coins in 1878 they continued to circulate and therefore the gold standard was limped. In both the LMU and the SWU the policy of minting and bond issuing differed among the member countries and this led to market prices which deviated from the established parities (see Table 1).

– zum Vergrößern bitte auf die Grafik klicken –

Due to an export boom, Denmark and Norway minted significantly more bank notes than Sweden. This led to the previously described shift in market prices. The start of the First World War was accompanied by a strong fixation on the national monetary interests of all member countries. Monetary policy oriented towards the interests of the union faded further into the background. With its official notice of withdrawal on January 1, 1927, Belgium effectively brought about the end of the LMU. In the context of this study Belgium is to be recognized as the first nation in the factual order of exit. Switzerland, meanwhile, soon followed, quickly making its desire to leave the union clear through its withdrawal from the union and demonetization of the union members’ coins. They shared the common goal of the introduction of a pure gold standard and therefore monetary interests which differed from those of the union. France and Italy were, respectively, the third and fourth nations to leave the union. One of the ways they showed their disinterest in a unified and union oriented monetary policy was in their assignation of a forced exchange by suspension of the requirement to honor the union’s bank notes. Greece, the fifth member nation to exit the LMU, only ever formally incorporated the coinage system. It never actively demonstrated its desire to exit the union.

The factual end of the SMU occurred in 1921 with the introduction of a comprehensive ban on coin exports. Its official end came in 1931 with the transition of all member countries to paper currency. Sweden was first in the factual sequence of exit of the member countries, as it was strongly affected by market prices deviating from established parities. Norway, which had taken for the most part oppositional positions in union monetary policy decisions, was the second country to leave the SMU. It followed the goal of expansion of the political sovereignty it had received in 1905. Denmark, the third country to leave the union, also increasingly followed national as opposed to union interests.

The Krone- and Rouble Zones

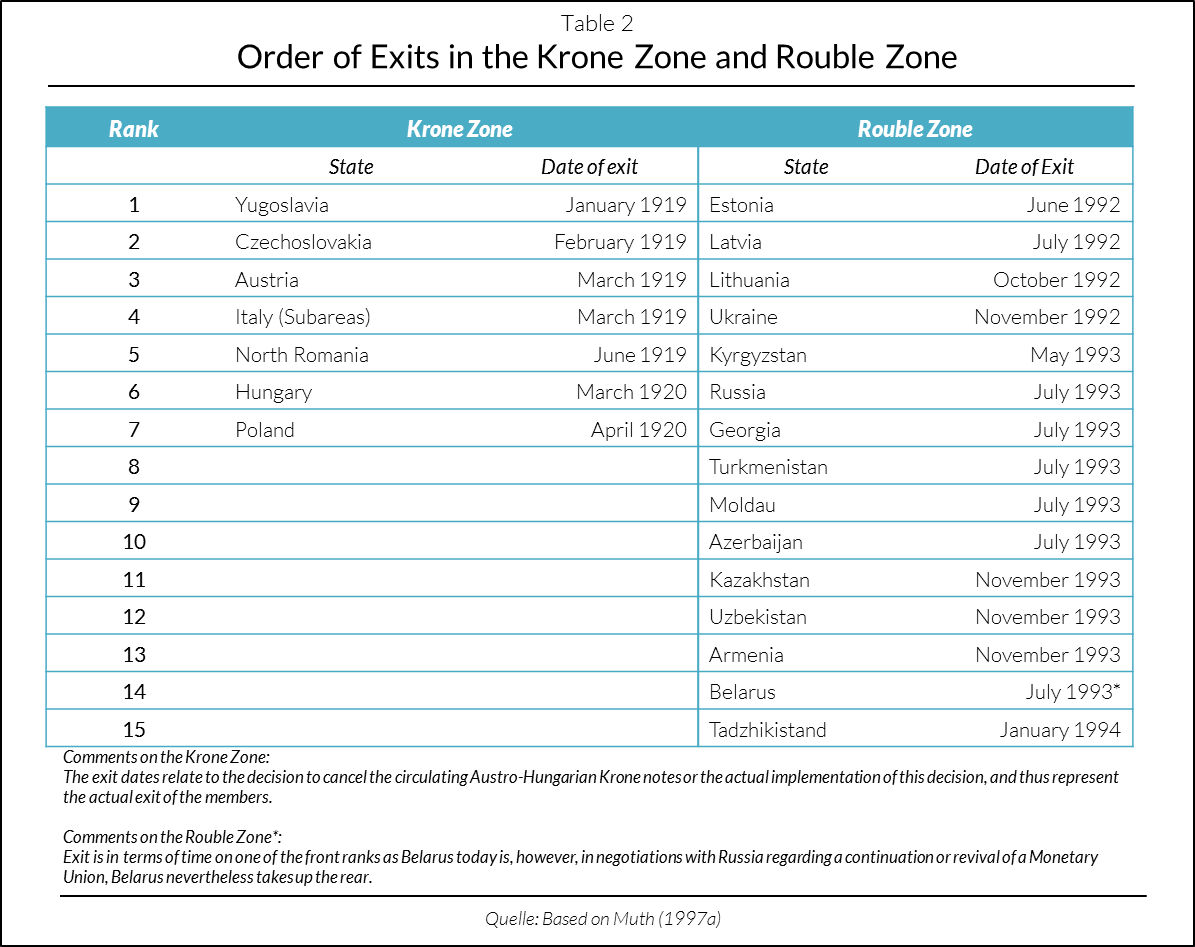

Here the monetary unions to be examined are those of the Krone Zone and the Rouble Zone. The Krone Zone (KRZ) arose following the collapse of the former Austro-Hungarian monarchy at the end of the First World War. It was composed of the now sovereign federal states Austria, Hungary, the newly formed Czechoslovakia, as well as parts of Poland, Italy, the also recently formed kingdom of Yugoslavia, and northwest Romania. Following the fall of the Soviet Union, the Rouble Zone (RZ) was comprised of its 15 now sovereign successor republics. As is apparent, these monetary unions arose more or less unintentionally due to the dissolution of territorial associations. They arose furthermore through the continued circulation of a common currency in the area of the former nation states. Here a comparison to the EMU can be made, in that it is also a union composed of sovereign states with identical currency, and features elements of a centralized monetary system. The issuing of cash in the RZ was centrally controlled by Russia. Meanwhile the Austro-Hungarian bank, which had its headquarters in Vienna, made decisions of monetary policy as the central bank of the KRZ.

The uncoordinated lending of the central banks of the individual republics of the USSR and the expansion of the Austro-Hungarian monarchy’s money supply due to the war caused both the soviet Rouble and the Austro-Hungarian Krone to be subject to high inflation rates from the very beginning of both unions. Additionally, in both cases a situation of political disintegration predominated which interfered with successful monetary policy cooperation.The members of the KRZ stepped out of union between 1919-1920 through the cancellation of the Krone notes which were in circulation at the time and their subsequent replacement with other currencies (see Table 2).

– zum Vergrößern bitte auf die Grafik klicken –

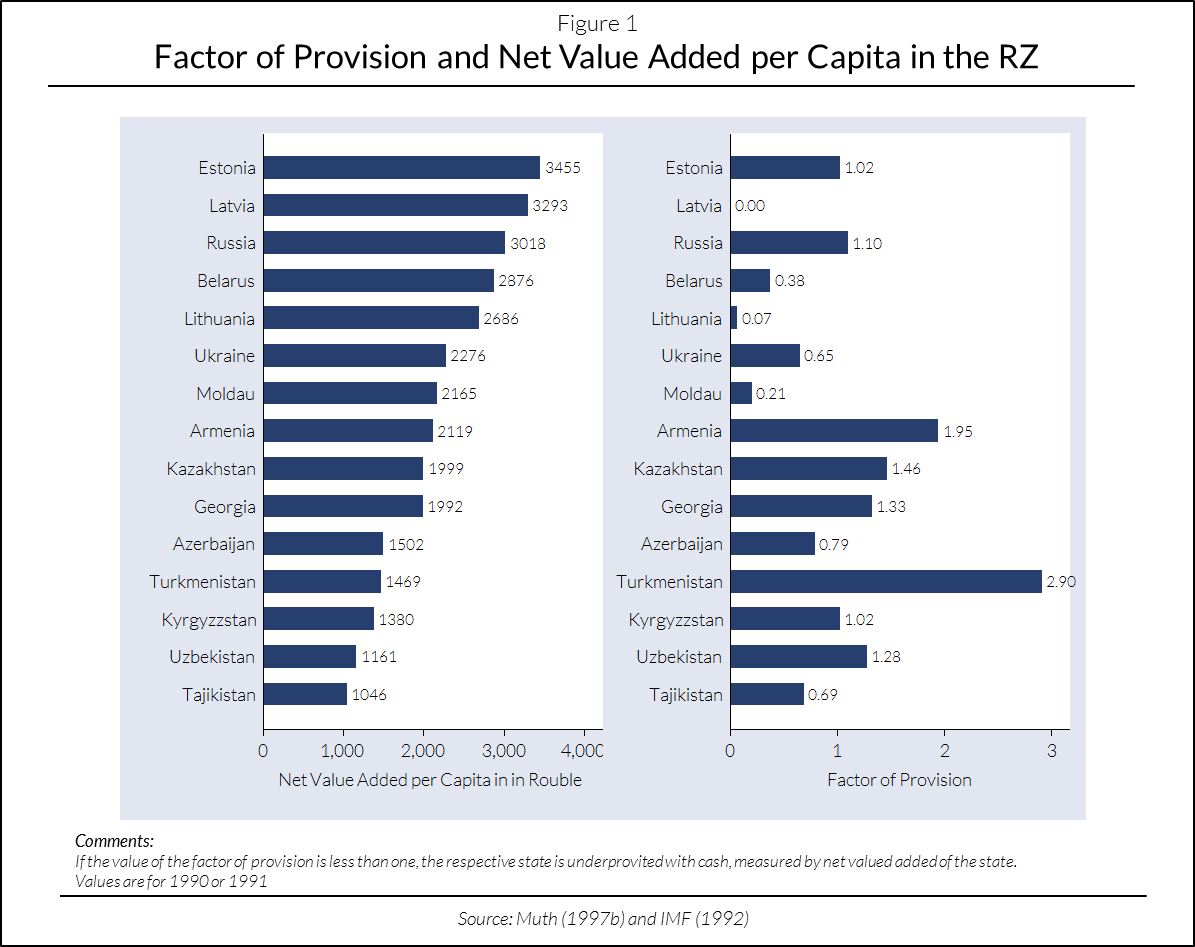

Yugoslavia removed itself from the union and instigated a so called exit race among remaining member nations when it cancelled the Austro-Hungarian Krone. This resulted in the inflow of unstamped banknotes into other member nations, accompanied by fear of prolonged increase in inflation. This strengthened the desire of all remaining member nations to leave the union. Those former regions of the Hapsburg Empire which now make up parts of Romania, Italy and Yugoslavia, now had the possibility to become incorporated into existing currency areas. This could be achieved through the acceptance of already circulating parallel currencies. This, as well as new political orientation due to newly formed territorial alliances and structures and the goal of creating a unified currency system drove the decision to leave the union. The previously discussed reasons also led to Poland’s decision to exit the union. Meanwhile, due to the Austria and Hungary’s historically required secure access to central bank credit, there initially existed no need for them to act. The exit race, however, captured these two countries as well. In spite of its recently acquired sovereignty Czechoslovakia could conceive of continuing monetary policy cooperation. The basis for Czechoslovakia’s exit was the repudiated demand that all partners in the unions be granted more say in monetary decisions. The exit of Estonia from the RZ triggered a similar exit race to that which occurred in the KRZ (see Table 2). The grounds for withdrawing of member countries from the RZ had their roots in strong independence movements with the implicit demand for political and monetary sovereignty – above all in the Baltic States – and the unequal cash supply provided by Russia (see Figure 1).

– zum Vergrößern bitte auf die Grafik klicken –

Historical Causes of Exit in the Context of the EMU

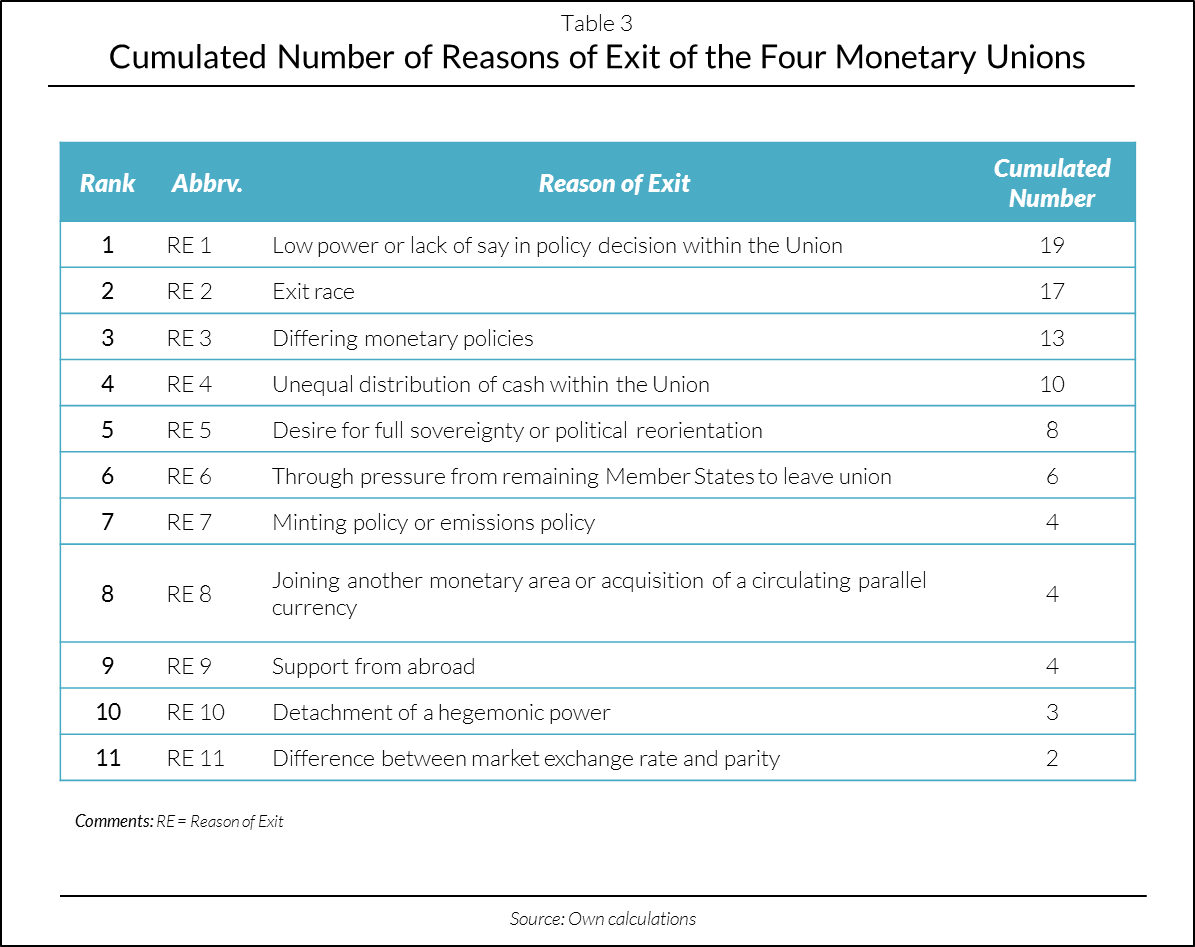

The currency areas considered thus far show that throughout history there have been different reasons for the collapse of monetary unions and that there exist various reasons for the exit of their individual members. Heterogeneous geographic, political, and economic developments play a large roll here. In spite of this variety, the member countries of all four currency areas feature similarities. Specific reasons for exit are seen to arise repeatedly, regardless of time period or location of a region. Table 3 provides an overview of the most common grounds for exit in the currency areas featured in this study. The goal of the following section will be to analyze whether and to what extent the causalities present in the previously described currency areas hold true for the present members of the EMU.

– zum Vergrößern bitte auf die Grafik klicken –

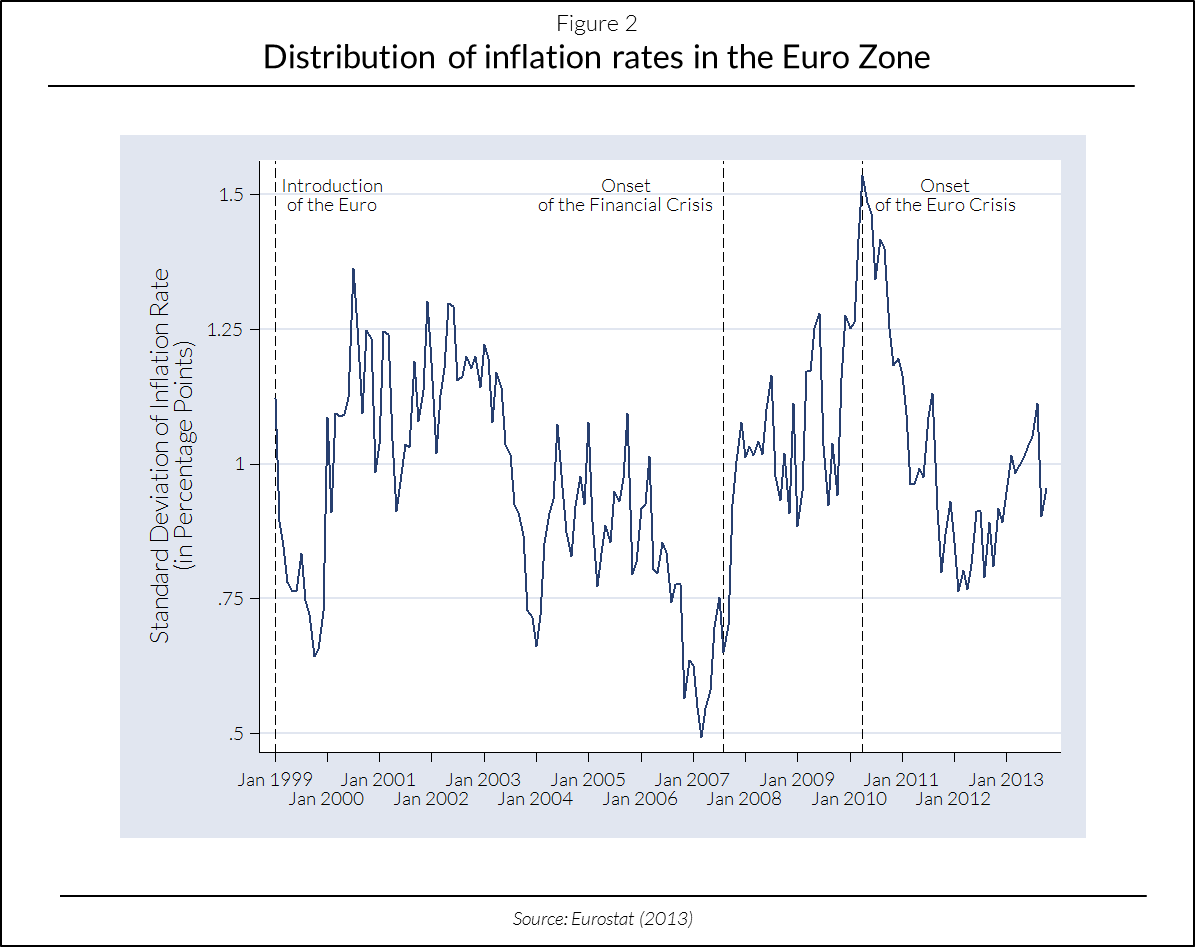

A lack of influence within the union (RE 1) expresses itself in the historical monetary unions through an unequal distribution of say in questions of monetary policy. Today in the EMU, however, there is a “One Person – One Vote“ principle. The votes of the national central banks are therefore equally distributed in the council of the European Central Bank (ECB). This could, however, change with the introduction of the rotation scheme proposed by the ECB-Council in 2002, which would occur upon the entry of a 19th Euro Zone member. This will be the case as early as January of 2015 with the entry of Lithuania. After this time the nineteen national central banks are intended to be divided into two groups. The national banks of the five countries with the most economic strength and largest finance sector will make up one group (Group 1) and will be given four votes to divide among themselves, leaving one country without a vote. The remaining 14 issuing banks (Group 2) will be granted a total of 11 votes. In each group the countries in possession of voting rights will change monthly. Through the temporary loss of voting rights, currently capital-intensive countries like Germany and France could find themselves at a disadvantage during decision making which could, for example, increase their liability risks. At present these two countries together hold 48% of ECB assets. In the historical unions such limited say has often been the cause of a country’s decision to leave the union. Hence the possibility exists that this could also occur in the EMU. Within the historical monetary unions monetary goals which deviated from the common aims of the union (RE 3), among others through different targets of the governments towards inflation, became clear. With regard to its monetary policy, as an independent institution the ECB cannot be weighted in any member country`s favor. Its unified monetary policy for the Euro Zone can, however, become problematic, especially in periods of financial crisis. When one considers the variance of inflation rates in the Euro Zone on the basis of their standard deviation, it becomes apparent that following the introduction of the Euro there began a gradual process of convergence between the member countries (see Figure 2). With the onset of the financial crisis, however, the rate of dispersion once again increased dramatically. Only through intense intervention in the money market following the outbreak of the euro crisis was the ECB successful in reducing this spread. Along with such crises comes a corresponding increase in political pressure on those national governments which find themselves on the ends of the inflation distribution. For them, a common monetary policy is not necessarily beneficial.

– zum Vergrößern bitte auf die Grafik klicken –

Within the EMU there exist no such sovereign issuing banks such as were to be found in the LMU. Therefore the possibility to increase emission of national currency (RE 7) without the consent of the ECB does not exist in this sense. Since 2007, however, the strongly divergent TARGET2-balances within the EMU countries show a relocation of central bank credit from the core countries (e.g. Germany) into the peripheral countries (e.g. Greece). TARGET2 is the payment system of the national central banks of the euro system. Positive balances indicate that national central banks hold assets of the ECB whereby negative balances indicate that these banks owe liabilities to the ECB. Admittedly this is not a case of direct issuing of money; however, the negative balances determine those additional funds, which the national central banks have excessively borrowed for internal money supply and used for net purchase of goods and assets from the rest of the Euro Zone. Figure 3 shows that six years after the beginning of the financial crisis this imbalance is still encompassing horrendous amounts of wealth. Currently the sum of the TARGET2-balances amounts to just fewer than 35% of the EMU-GDPs. It is true that the ISA-balances, as the United States’ counterpart to the TARGET2-balances, also increased following the onset of the financial crisis; however they swung back to a lower level a short time later. The enormous increase of balances in the southern EMU countries following the onset of the debt crisis is an indication that the TARGET2-system is being used to convey money indirectly into the debtor countries. Those divergent currency emissions could serve as a potential reason for exit to some extent applicable in the EMU.

– zum Vergrößern bitte auf die Grafik klicken –

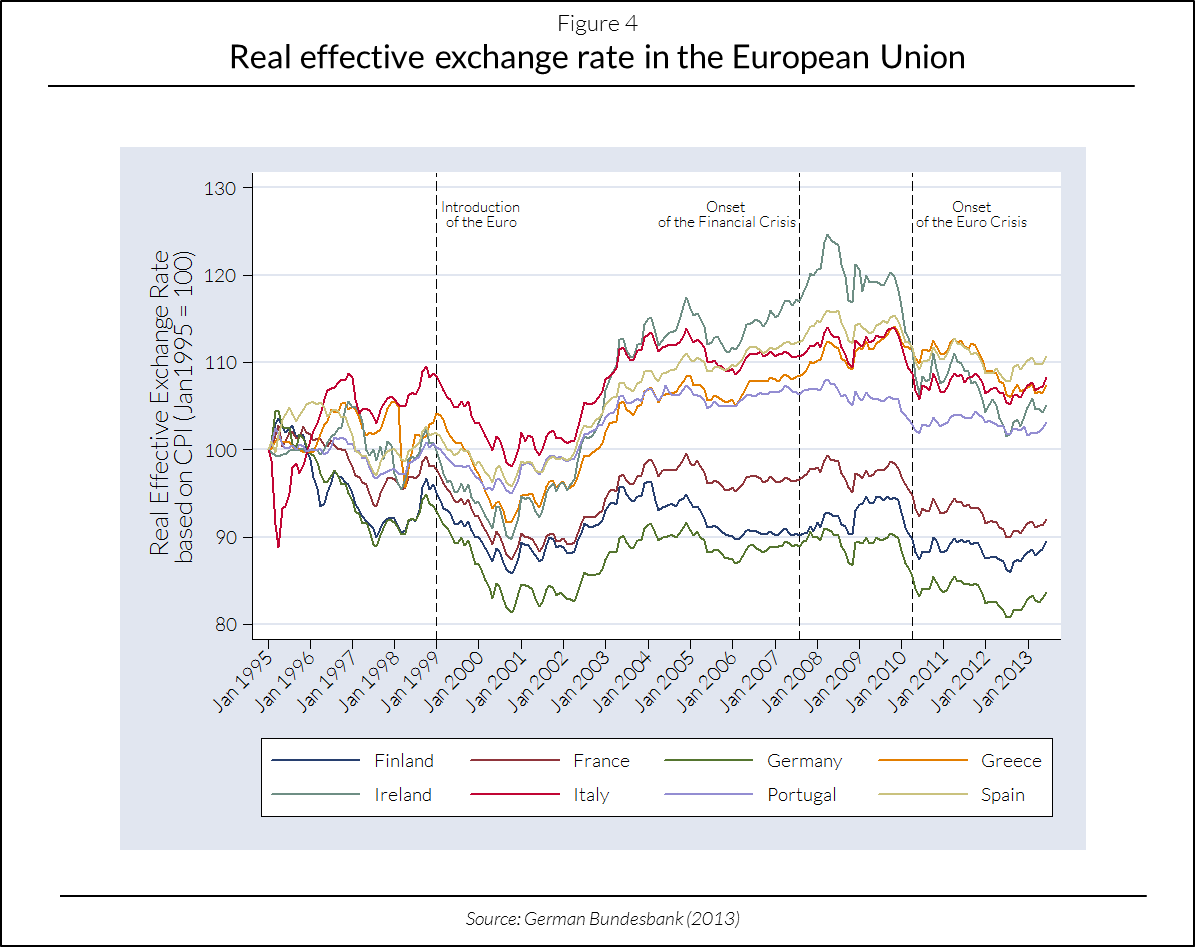

The shared currency in the EMU prevents a deviation in market prices (RE 11) away from the fixed parities, as was the case in both the LMU and the SMU. As a consequence structural differences between the individual member countries no longer lead to nominal exchange rate adjustments. They become apparent in the relative national prices and wages. By comparison to the real effective exchange rate this deferment of the actual exchange ratios can be analyzed. Figure 4 shows a similar development among the selected members shortly after the introduction of the Euro. Already before the onset of the financial crisis the appearance of diverging trends between the union members can be observed. Over the course of the finance and euro crises the southern members demonstrate a continuously weaker competitive position than the large economies of Germany and France.

– zum Vergrößern bitte auf die Grafik klicken –

Compared with these reasons for exit, which are fairly applicable to the current situation in the EMU, the remaining reasons show a relatively weak comparability. The explanation for this is, among others, that these reasons were shaped to a large extent by the historical, political and institutional realities of the times which do not correspond directly to those of the current situation in the EMU. The drawing of hegemonic power (RE 10), however, is becoming more relevant due to the increasing perception of hegemonic power occupied by Germany within the EMU. In regard to the first five countries of the exit order in the large historical monetary unions of the LMU, KRZ, and RZ, it is apparent that relatively small (measured by population) and strong (measured by GDP per capita) members often take front ranks.

– zum Vergrößern bitte auf die Grafik klicken –

Applying this trend to the Euro Zone in the hypothetical case of termination of the union, the corresponding countries in leaving the monetary union would be Finland, Ireland, Austria, the Netherlands, and Belgium.

Conclusion

A close consideration of history often allows conclusions to be drawn about the present. A number of similarities between the collapses of the four described historical currency areas are recognizable, independent from their historical dimensions. Behind the causes of decisions to exit from and ultimately break up currency unions there are always divergent national interests. They become manifest in different monetary goals and fiscal decisions, first orientated towards national needs and desires and later towards the interests of the union. Different policies within currency areas are again reflected in the development of effective exchange rates and thus also in the competitiveness of a country. Whereas countries which expect to suffer under these conditions leave the union to minimize their losses, those which profit hold on tightly. Some of the historical reasons for exit from and dissolution of currency unions could also hold true for the EMU and its member countries. So far the divergent overall development of the economy of the Euro Zone as a whole since the onset of the financial crisis has not subsided. The wealth gap between the south and the north in the EMU is once more increasing and the solidarity between the members is largely exhausted. Whether and how a convergence will be possible in the future strongly depends on the competitiveness of the southern members. An increasing heterogeneity within the union raises probability that certain countries will leave it.

Hinweis

Dieser Beitrag ist die englischsprachige Version des Artikels „Das Scheitern historischer Währungsräume. Kann sich die Geschichte für die Eurozone wiederholen“, der auf diesem Blog am 12. August 2014 erschienen ist.

Schöner Beitrag. Hiernach werden Finland (FIXIT) und die Niederlande (NEXIT) als erste die Eurozone verlassen.

Deutschland kommt aufgrund seiner Größe und seiner immer noch vorherrschenden Schuldgefühle nicht in Betracht, die Peripherieländer erst recht nicht.